President Biden wants half of all new car sales in America to be electric by the end of the decade. It’s a bold goal—and it won’t be easy. It will require a lot of lithium, batteries, EV charging, and EV manufacturing capacity. Most important, it will require billions and billions of dollars.

Wednesday, the White House announced plans for Biden to sign an executive order supporting his goals of boosting the U.S. EV business. “The President believes it is time for the U.S. to lead in electric vehicle manufacturing, infrastructure, and innovation,” reads the news release.

It’s a tall order. There are only about 2 million EVs on U.S. roads today, and only about 2% of all cars sold in 2020 were all-electric. That works out to roughly 250,000 out of 16 million light vehicles. What’s more, General Motors (ticker: GM) delivered 1.3 million cars in the U.S. during the first half of 2021, and only 20,300 were EVs, just 1.6%.

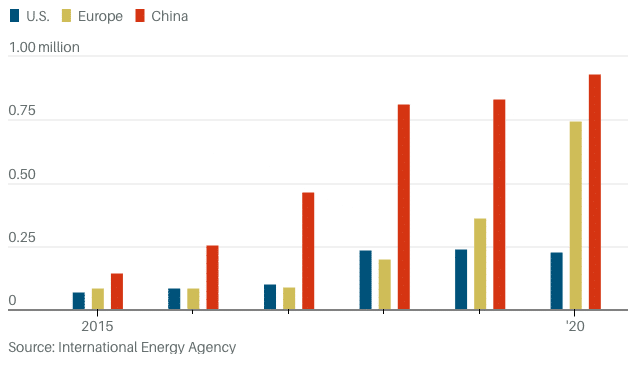

The Electrification Gap

Annual unit sales of battery-electric vehicles by region.Source: International Energy Agency

GM, of course, has already announced plans to invest $35 billion in EV development between 2020 and 2025, which includes about $8 billion for battery capacity. That is supposed to result in 1 million EV sales a year, giving investors a useful rule of thumb.

If one million EVs need $8 billion of battery capacity, then 8 million EVs—about 50% of U.S. annual light vehicle sales—will require $64 billion.

And that’s just the battery capacity. Auto makers have to engineer and assemble the EVs too. Estimating capacity costs is a little harder because car plants have to be maintained and updated continuously. Ford Motor (F) spends roughly $5 billion to $7 billion a year maintaining and updating its 5 million to 6 million car assembly capacity. But Tesla (TSLA) has spent roughly $5 billion over the past few years installing about 1.5 million units of brand new EV capacity in Shanghai, Germany, and Texas—call it $3 billion for 1 million in assembly capacity. That means an additional $22 billion will need to be spent to increase and retool automotive capacity.

Then there is charging infrastructure. There are 150,000 gas stations in America and only a few thousand fast-charging stations. Of course, people plug EVs in at home, but they still need to be able to charge up while on the road. The fastest chargers cost about $100,000 each, according to Arcady Sosinov, CEO of FreeWire, which builds charging equipment with battery backup that doesn’t require complicated utility hookups. That price doesn’t include installation. To get to, say, 50,000 fast-charging stations might require another $10 billion.

That’s almost $100 billion in spending over the next nine years—in the U.S. alone—to have the capacity to build enough cars and batteries to reach Biden’s goal and to keep the infrastructure to enable their adoption. It’s certainly possible to spend that—there will be many companies, many industries, and many years involved—and that’s good news for EV charging companies such as ChargePoint(CHPT) and providers of capital and automation equipment such as Rockwell Automation (ROK), among others.

It’s also good for battery makers such as China’s CATL (300750.China), which has spent about $3 billion over the past 12 months boosting its capacity as Chinese EV sales expand rapidly. All the largest battery makers in the world are foreign, based in Korea, Japan, and China.

The spending won’t stop there. Batteries need lithium, so the lithium mining industry has to ramp capacity too. In 2020, the world was mining about 400,000 tons of lithium a year, enough to power 2 million to 3 million EVs a year, although only about one-third of global output is destined for cars. Don’t forget phones need batteries too.

If the U.S. is making 8 million EVs and the rest of the world is doing similar things, then the world will need to mine an incremental 5 million tons of lithium a year. It’s a massive 13-fold increase for the industry. That’s means demand growth as far as the eye can see and is good news for miners such as Albemarle(ALB). Albemarle is spending about $800 million $900 million a year on maintaining and expanding its operations. Albemarle has a roughly 20% market share of the global lithium mining market. That doesn’t including lithium refining, however, which mainly happens in China.

All this adds up to about 40 billion lithium-ion battery cells for the U.S. by 2030 and, perhaps, 225 billion annually for the globe. It’s a huge number and doesn’t include batteries going into power storage applications for utilities and backup power for consumers.

It’s a massive transition, one that has been enabled by falling battery costs and success from the likes of Tesla. But taking it mainstream will require hundreds of billions of dollars. It’s one of the largest changes in the car business in the last 100-plus years.

For not, stocks aren’t really reacting to the announcement. Tesla is up 1.2% The S&P 500 and Dow Jones Industrial Average are up 0.4% and 0.6%, respectively.

The market doesn’t typically react to 2030 targets set by politicians—but the transition is under way nonetheless.

Source : Barron’s