Renewable power sources will mark their first annual decline in new additions in 20 years, owing to delays in construction activity, supply chain disruptions, lockdown and social distancing measures, and emerging financing challenges related to the COVID-19 pandemic. Despite this, the sector has showed “impressive” resilience, said the International Energy Agency (IEA) in a new report.

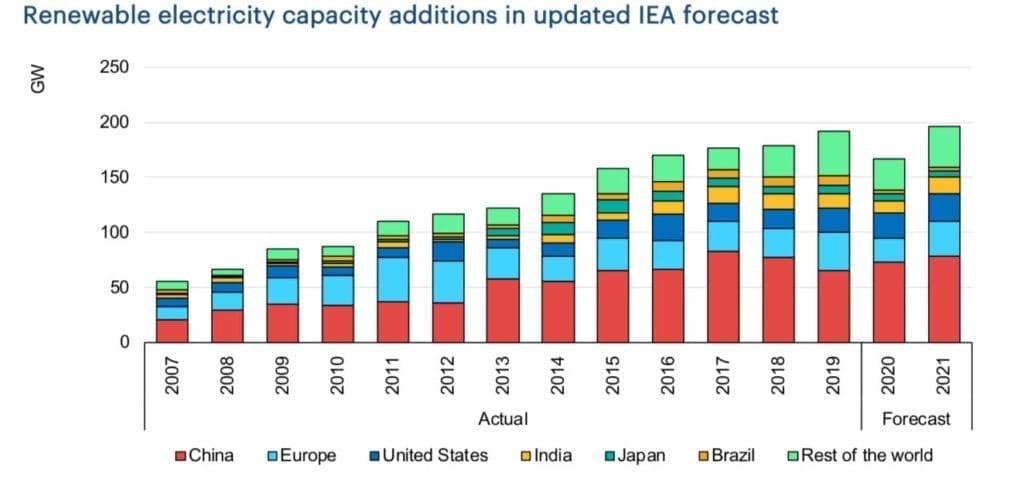

The IEA’s Renewable Market Update report released May 20 suggests that renewable power capacity additions continue an upward climb and are expected to increase by 167 GW in 2020, or 6% compared to 2019. But growth of net additions will still be 13% smaller than in 2019, it notes. And in 2021, while the sector may see a “rebound” as the majority of delayed projects come online, “combined growth in 2020 and 2021 is almost 10% lower compared to the previous IEA forecast published in October 2019,” the agency says.

The IEA noted these projections for renewable power growth are still optimistic compared to other generation resources. In its Global Energy Review 2020 released April 30, a flagship report that assessed COVID impacts on global electricity demand and supply, it said renewables-based generation spurted 3% in the first quarter of 2020 compared to 2019. That’s despite depressed demand of up to 20% in some countries during periods of full lockdown, as upticks for residential demand were far outweighed by reductions in commercial and industrial operations.

The agency has painted a far more dismal picture for coal-fired power generation, whose output fell by 8% in the first quarter of 2020 compared to 2019. In the first quarter, nuclear power generation also fell by 3% in response to lower demand, and because fewer reactors were operational in some regions. Gas-fired generation, however, increased by 4%, “buoyed by low prices for natural gas in markets around the world,” it said.

As the IEA noted Wednesday, a key reason existing renewable plants are mostly sheltered from lower demand and declining prices is that many plants have fixed-price contracts and are granted priority access to the grid, resulting in little or no output curtailment. Some regions—like Italy, Austria, and Belgium—are noting record-high shares of power from renewables compared to last year, reaching penetrations of up to 70%.

Even with such high variable renewable energy shares, security of supply has not been jeopardized during the current crisis, though the IEA cautions more challenging conditions could arise as summer approaches. “COVID-19 may require system operators to make use of balancing tools more frequently and for longer than in past summers, as is already stated by Great Britain ́s electricity system operator (National GridESO), in their April 2020 Summer Outlook,” the report notes.

Biggest Impact on Solar PV and Wind

The newer update to the agency’s renewables market report notes that COVID impacts will not affect all renewable source equally. Additions of solar PV and wind, which account for 86% of global renewable capacity additions this year, will suffer the most pronounced declines of 18% and 12% respectively compared to 2019. For solar PV, that means additions could decline from 110 GW in 2019 to just more than 90 GW in 2020.

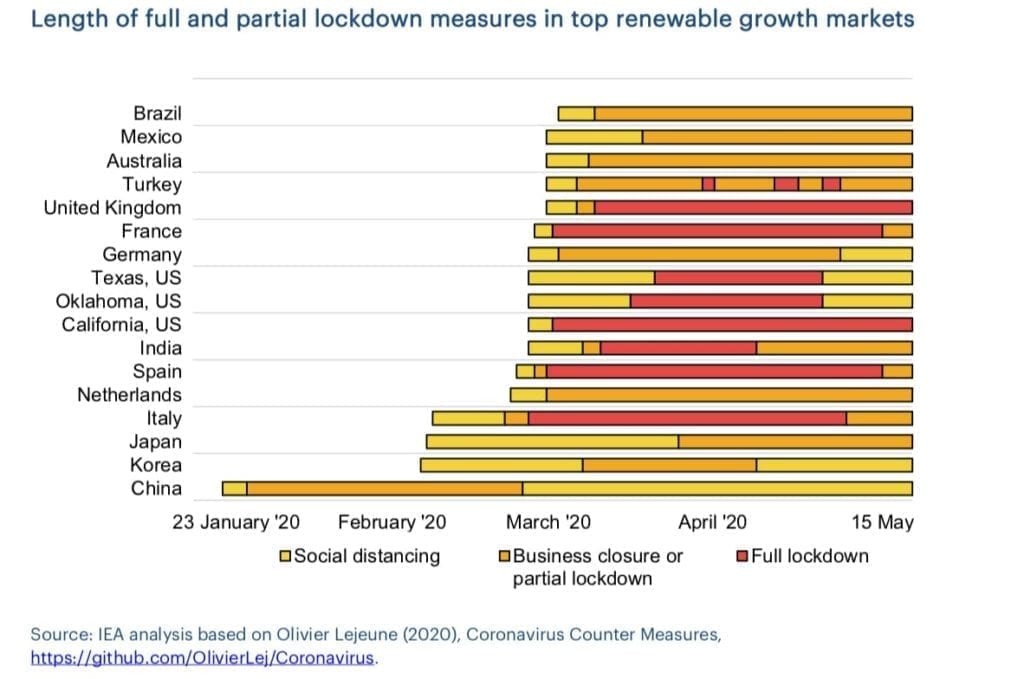

Along with supply chain disruptions, labor constraints, and construction delays, which have had a direct impact on the commissioning of renewable projects, restrictions on business activities, travel, and border closures have limited the industry. “Emerging macroeconomic challenges may prompt cancellation or suspension of investment decisions for both large and small-scale projects under development. All of these factors may put projects at risk, even if they are at an advanced stage,” the report notes.

The level of risk, however, varies considerably by sector. While China accounts for 70% of global PV module manufacturing, despite early production slowdowns, a significant manufacturing overcapacity in the PV market persists, allowing most developers to withstand supply chain issues and logistical delays. In fact, the IEA expects that with the completion of additional manufacturing facilities in China in 2020, “the supply glut is expected to reach its highest level ever globally, fostering competition and increasing downward pressure on module prices.” COVID-related risks for the solar PV sector are centered more on the point of sale, where lockdowns have slowed construction activity and increased risks of commissioning delays.

Still, utility-scale PV and wind are expected to rebound as the majority of projects in the pipeline are already financed and under construction. Yet, “forecast uncertainty remains for projects that were due to achieve financial close in 2020 and become operational next year. Moreover, total PV additions in 2021 are expected to fall short compared to 2019 due to slower recovery of distributed PV applications, as individuals and small business are expected to re-prioritise investment decisions,” the report says.

The distributed PV sector is more at risk because “it relies on both individuals and [small- and medium- enterprises], who are more severely affected by lockdown measures and any economic downturn resulting from COVID-19; they will be reluctant to invest in such systems as they look to save money or reduce capital spending,” the report explains.

In contrast, risks for the wind sector stem from recent lockdowns in major manufacturing hubs, such as in China, Italy, and Spain, which have disrupted wind turbine supply chains. For biomass power, risks are centered on lockdown-related delays of project construction, but existing projects may continue to thrive, because biomass fuel supply chains for wood chips and pellets have not been significantly affected. Forestry activity is ongoing and ports are operational, the IEA said.

COVID’s impact on renewables with longer lead times, such as hydropower, offshore wind, concentrated solar power (CSP), and geothermal remains “limited,” it notes. Hydropower capacity additions will grow both this year and next, driven by the commissioning of two mega-hydropower projects in China: the 10.2-GW Wudongde hydropower station, and the 16-GW Baihetan hydropower project.

The IEA’s forecast for offshore wind, meanwhile, remains unchanged, mainly because most projects are already financed and under construction. According to the Global Wind Energy Council (GWEC), however, COVID impacts on both workforce and turbine supply chain have yet to be fully quantified. GWEC’s market intelligence arm expects “there to be minor impacts for the markets,” noting global offshore wind trade group Global Wind Organizationhas begun rolling out digital training platforms to continue training the workforce during the crisis.

Delays Are Compounding Incentive Timeframes

The IEA points out that not all countries have limited work on renewable power projects. India, for example, allowed construction of renewable projects to continue during its three-week full lockdown, while major construction firms in Japan suspended work in response to the state of emergency.

Pandemic-related delays have impacted developer efforts to meet incentive package deadlines that end in 2020 in the U.S., China, and Europe. A number of countries have introduced policy changes to provide flexibility for delays, including Austria, Denmark, France, Germany, Greece, India, the UK, and the U.S.

In the U.S., the Department of Treasury on May 7 said it plans to modify rules “in the near future” as they relate to the continuity of safe harbor provided under existing guidance for the production tax credit (PTC) and the energy investment tax credit (ITC). The agency was responding to an April 23 letter from a bipartisan group of senators that sought an extension of the “continuity safe harbor” from four years to five years for projects that began construction in 2016 or 2017 under both tax credits.

Because it is not known how the pandemic will play out, and whether new lockdown measures will be implemented, the IEA underscores efforts to mitigate that uncertainty may be crucial. “At the start of this year, renewables in several markets were already facing challenges regarding financing, policy uncertainty and grid integration. COVID-19 is now intensifying these concerns,” it said.

The agency notably called on governments to “reverse this trend” by making renewables key parts of stimulus packages designed to reinvigorate economies. “This offers the prospect of harnessing the structural benefits that increasingly affordable renewables can bring, including opportunities for creating jobs and economic development, while reducing emissions and fostering innovation,” the agency said.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).